The Companies Act provides that a dividend can be paid only. A company cannot pass a resolution for the declaration of dividend without passing a resolution for the adoption of accounts.

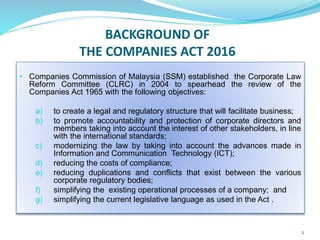

The Malaysian Companies Act 2016

1 No dividend shall be declared or paid by a company for any financial year except.

. A out of the profits of the company for that. 1A Subject to subsection 1B any profits of a company applied towards the purchase or. 1 No dividend is payable to the shareholders of any company except out of profits.

Out of moneys provided by. The Companies Act 71 of 2008 as amended the Act provides a very wide definition of a distribution which goes much further than just cash dividends. 1 In this Part an investment company means a public company that.

Section 2 35 of Companies Act 2013 Act for short defines the term as including any interim dividend. No dividend shall be declared or paid by a company for any financial year except. Companies Commission of Malaysia.

Or d upon the application of moneys held by the. The entire Companies Act 2016 will come into operation except for the sections on. And 2 the dividend should not be paid if.

Whist the Companies Act 2016 provides for the distribution of dividends by companies companies at times do not provide dividends much to the chagrin of shareholders. 1 The rate of dividend declared shall not exceed the average of the rates at which dividend was declared by it in the three years immediately preceding that year. Dividend shall be paid within.

A Board Meeting should be called by issuing a. 1 No dividend shall be declared or paid by a company for any financial year except. Substituted by the Companies Declaration and Payment of Dividend Amendment Rules 2014 vide Notification.

Within five days of declaration of Dividend separate bank is required to be opened and amount of Dividend shall be credited to such Bank account. A has given notice which has not been revoked to the registrar of its. No exact definition has been given in the Act.

833 Meaning of investment companyUK. Out of the profits of the previous years or. 1 the company secretarys registration with the Registrar of Companies.

And 2 must take into account all of the companys. A out of the profits of the company for that year arrived at after providing for depreciation in accordance with the provisions of sub-section 2 or out of the profits of the company for any previous financial year or years arrived at after providing for. It has two principles ie 1 the dividend is to be paid out of the companys profits.

Regulation 12 43 of LODR. Declaration of dividend. Last amendment on 29052015.

The directors opinion must be 1 based on the directors inquiry into the companys state of affairs and prospects. In satisfaction of a dividend declared in favour of but not payable in cash to the shareholders. Out of the profits of the Current financial year or.

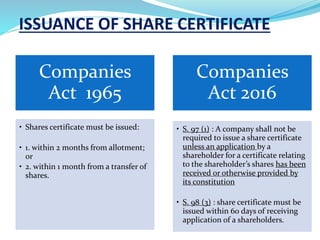

Hence a company shall adopt its books of. Out of the profits of the company for that year arrived at after. Dividend In the CA 2016 the dividend rule is found in s131.

The Articles must provide power to pay Interim dividend and Board must be authorized to declare Interim dividend.

The Malaysian Companies Act 2016

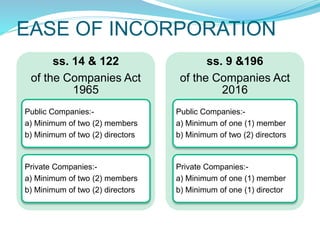

Companies Act 2016 Companies Types Of Companies Section 10 Of Companies Act 2016 1 A Company Studocu

_bill_2016_1510037412_19196-17.jpg)

Company Bill Powerpoint Slides

The Malaysian Companies Act 2016

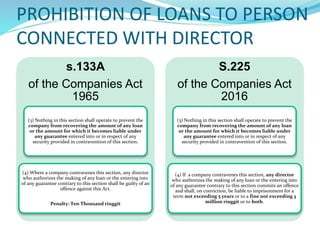

Key Changes About The New Companies Act In Malaysia Lo Partnerslo Partners

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

Preference Shares Case Facts By Hhq Law Firm In Kl Malaysia

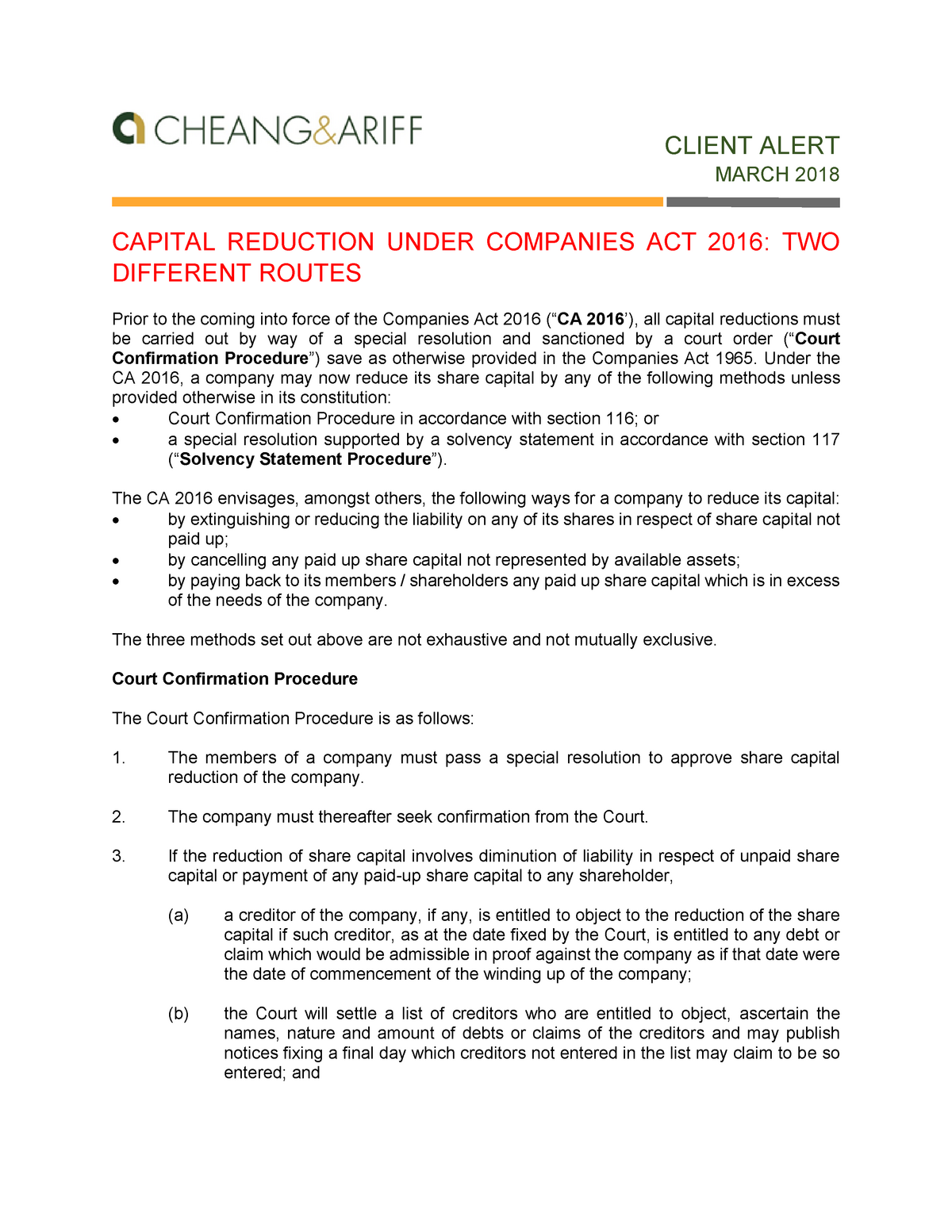

Capital Reduction Under Companies Act 2016 Client Alert March 2018 Capital Reduction Under Studocu

The Malaysian Companies Act 2016

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings